Worthwhile

Quick, user-friendly options available globally. Just one document to start

Quick, user-friendly options available globally. Just one document to start

Trust us as your direct lender with a modern approach! Your data stays safe, and we support you in tough times

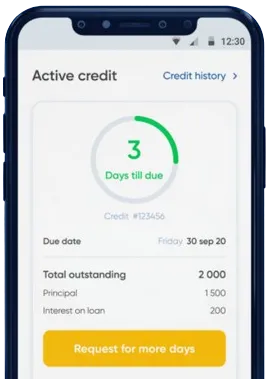

Straightforward solutions in just minutes from home. Money is transferred instantly; extend loans as needed

Make your request in the app, just complete the form.

Await approval. Decisions are typically made within 15 minutes.

Collect your money, with transactions often completed in one minute.

Payday loans in Durban offer a convenient and accessible way for individuals to access quick cash when they are in need of immediate financial assistance. These loans are designed to be a short-term solution for unexpected expenses or emergencies and can help individuals bridge the gap between paydays.

With the ease of online applications, individuals can apply for payday loans from the comfort of their own homes, making the process quick and efficient. This convenience is especially beneficial for those who may not have the time or resources to visit a physical bank or lending institution.

One of the key benefits of payday loans in Durban is the speed at which funds can be accessed. Many lenders offer same-day or next-day approval, meaning individuals can receive the funds they need in a timely manner. This quick turnaround time can be crucial for those facing urgent financial needs.

In addition to the speed of access, payday loans also do not typically require a credit check, making them accessible to individuals with less-than-perfect credit histories. This inclusivity allows more people to take advantage of these loans and can be a lifeline for those who may struggle to access traditional forms of credit.

Payday loans can be a useful financial tool for individuals who find themselves in a temporary cash crunch. Whether facing unforeseen medical expenses, car repairs, or other emergency costs, payday loans can provide the necessary funds to address these urgent needs.

Additionally, payday loans can help individuals avoid costly late fees or overdraft charges that may occur if bills are not paid on time. By providing a short-term financial solution, these loans can help individuals manage their cash flow and avoid further financial hardship.

While payday loans can be a helpful resource in times of need, it is important for individuals to carefully consider their financial situation before taking out a loan. It is crucial to assess whether the loan is affordable and to have a plan in place for repayment.

By approaching payday loans responsibly and thoughtfully, individuals can benefit from the convenience and accessibility of these financial products without falling into a cycle of debt.

Payday loans in Durban can be a valuable resource for individuals in need of quick cash to address emergency expenses. With their fast approval process, flexible repayment options, and accessibility to individuals with varying credit histories, payday loans offer a convenient and useful financial solution for many South Africans.

A payday loan is a short-term loan that is typically borrowed to cover expenses until the borrower's next payday. In Durban, South Africa, payday loans are usually available from various financial institutions and lenders.

Payday loans in Durban work by allowing individuals to borrow a small amount of money for a short period of time, usually until their next payday. The borrower typically writes a post-dated check or provides authorization for the lender to withdraw the loan amount plus fees from their bank account on the due date.

Requirements to qualify for a payday loan in Durban may vary among lenders, but common requirements include proof of income, a valid South African ID, a bank account, and proof of residence. Some lenders may also require a credit check.

The amount you can borrow with a payday loan in Durban typically ranges from R500 to R8000, depending on the lender and your income level. It's important to borrow only what you need and can afford to repay on your next payday to avoid falling into a cycle of debt.

Fees and interest rates for payday loans in Durban can vary, but lenders are required to disclose all fees and charges upfront. It's important to review the terms and conditions carefully to understand the total cost of borrowing before taking out a payday loan.

Some lenders in Durban may offer extensions or rollovers on payday loans, but this can result in additional fees and interest charges. It's important to carefully consider whether extending a payday loan is the best option for your financial situation and to explore alternative repayment options if needed.